Choose the Best Investment Option

The investment funds of the Cleveland Foundation are guided by an Investment Committee, which is comprised of directors and external volunteers who are knowledgeable in investment and financial matters. The Investment Committee is advised by an independent consultant who, along with staff, assists in setting the investment policies and guidelines that govern the investments.

View our Investment Policy Statement (June 2014)

We understand that no single investment plan can meet every person’s needs. That’s why when your client creates a fund with the Cleveland Foundation, you and your client can choose to invest it in the following ways:

- Cleveland Foundation Flagship Pool

The Cleveland Foundation Flagship Pool combines a number of donor funds into a single portfolio. The pool allows participating donor funds access to investment managers and products that traditionally require a very high initial investment.

The Cleveland Foundation Flagship Pool follows a multiple-firms approach in which managers are hired for a specific asset class. This method gives the pool the broadest diversification possible in both asset classes and managers.

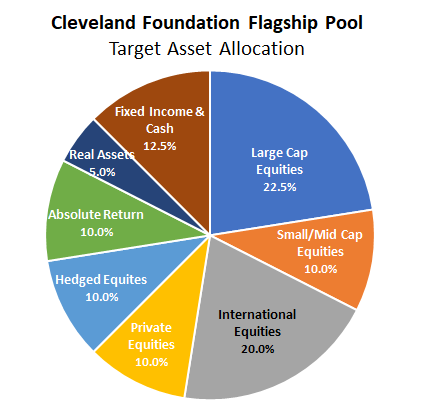

The Cleveland Foundation’s Investment Committee has set a target asset allocation for the pool, illustrated in the chart to the right.

The Investment Committee regularly monitors the performance of each of the pool’s managers to ensure they are continuing to meet the foundation’s investment standards.

To learn more about the Cleveland Foundation’s Impact Investing program, including our nationally recognized Socially Responsible Investment (SRI) Pool and Racial Equity Investment (REI) pool, please click here.

- Firms & Banks

The foundation, by declaration of trust, maintains active relationships with four trust banks, including KeyBank, PNC, Huntington, and JP Morgan and has also allowed local investment firms to manage assets. Because of the diversification of investments they offer, firms and banks provide a balanced investment approach through the use of specialized managers and multiple investment products in a given asset class. Firms and banks typically pool individual donor funds to provide greater administrative efficiencies and custody the assets with KeyBank.

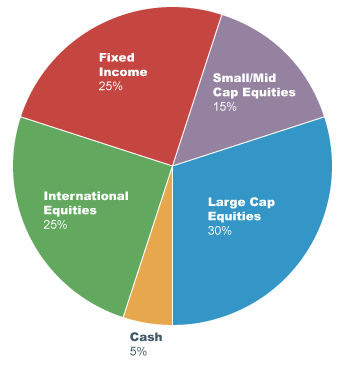

The firms and banks follow the asset allocation guidelines of the investment policy set forth by the Cleveland Foundation’s Investment Committee. Staff meets with the firms and banks at least twice annually, and the Investment Committee regularly monitors the performance of the managers to ensure they are continuing to meet the foundation’s investment standards. For the largest pools, which are managed by KeyBank and PNC, the target asset allocation is the same as that for the Cleveland Foundation Flagship Pool. For all other firms and banks, there are two sets of guidelines from which they can choose to manage assets, one with and one without alternative investments such as real estate, hedge funds, etc. The guideline targets are illustrated below.

Firms and Banks With Alternatives

Firms and Banks Without Alternatives

Individual advisors

Individual advisors are an option for donors looking to establish a significant fund (>$1 million) with the Cleveland Foundation while maintaining a relationship with their existing financial advisor.

General asset allocation guidelines are set by the Investment Committee and are the same as those in place for the firms and banks. Assets of a donor’s fund invested with an individual advisor are custodied at KeyBank and may or may not be pooled with other funds managed by a particular advisor. The Cleveland Foundation has relationships with individual advisors from the following firms:

- Baird Asset Management

- BDS Financial Network

- Carnegie Investment Counsel

- Clearstead

- Eton Financial Services

- Fairport Asset Management

- The Glenmede Trust Company

- Huntington National Bank

- JPMorgan Chase

- KeyBank

- McDonald Partners, LLC

- Merrill Lynch

- PNC Bank

- Sequoia Financial Group

- Stratos Wealth Partners

- UBS Financial Services

- Wells Fargo

- Winfield Associates, Inc.